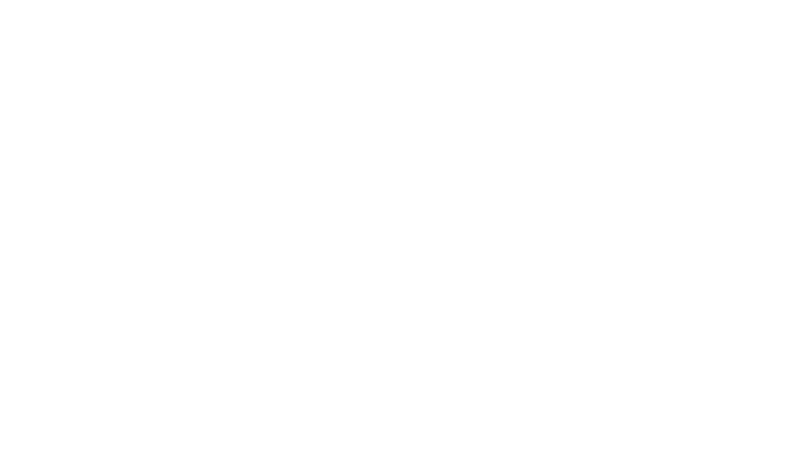

CNB Financial Corp. Announces Largest Acquisition in Its History: A $214 Million Deal for ESSA Bancorp

Clearfield, PA – January 11, 2025 – CNB Financial Corp., the parent company of CNB Bank, has announced its largest acquisition to date: a $214 million all-stock agreement to acquire in-state competitor ESSA Bancorp. The transaction, expected to close in the third quarter of 2025, will create an $8 billion-asset financial institution.

This strategic acquisition will expand CNB’s footprint into eastern Pennsylvania, including key markets like Scranton, Allentown, and suburban Philadelphia. The move aligns CNB with other regional consolidation trends, such as Mid Penn Bancorp’s recent $127 million acquisition of William Penn Bancorp.

Leaders’ Vision for Growth

“We’re excited to partner with ESSA,” said Michael Peduzzi, President and CEO of CNB Financial Corp. “This combination aligns two high-performing banks with an exceptional commitment to client-focused services and economic support for the communities we serve.”

Gary Olson, President and CEO of Stroudsburg-based ESSA Bancorp, echoed this sentiment, stating, “Leveraging CNB’s infrastructure, robust capital, and suite of banking products will enhance our community banking model and serve our customers better.”

Strategic and Financial Benefits

According to analyst Jake Civiello of Janney Montgomery Scott, the merger presents significant opportunities for profitability improvement, driven by ESSA’s lower cost of deposits and a larger combined lending capacity. CNB estimates $20.5 million in cost savings—equivalent to about 40% of ESSA’s projected 2026 noninterest expense base—and anticipates a 3.3-year earn-back period for the 15% tangible book value dilution.

While the projections show promise, Civiello noted the cost-saving target and tangible book value dilution are ambitious, warranting careful execution.

Historical Context and Future Plans

This marks CNB’s fourth acquisition since 2013, and by far its largest. Previous deals included smaller institutions, such as the $471.2 million-asset Bank of Akron in 2020. CNB’s multi-brand strategy, which includes five distinct brands and the 2023 launch of Impressia Bank to serve women entrepreneurs, will now include ESSA as its seventh division.

To ensure smooth integration, CNB plans to establish an advisory board for ESSA post-merger.

Leadership and Legacy

CNB, founded in 1865, has grown steadily under Peduzzi’s leadership since his appointment as CEO in 2022. This acquisition underscores the company’s ongoing commitment to growth and innovation in community banking.

Reference news :-